In this article, you will find out what the 50 30 20 method is

Would you like to manage your budget quickly and easily without having to spend hours doing complicated calculations?

What if I told you that this method exists!

What if I told you that there is a method that allows you, once implemented, to have a healthy and optimal management of your money and that allows you not to have to check every time at the end of the month that the accounts add up?

a method created by a Harvard professor!

Professor Elizabeth Warren , now vice president of the American Senate , who is one of the 100 most influential people in America according to TIME magazine

the 50/30/20 rule !!!

A cornerstone of personal finance, a method that everyone should know and apply

A system that I can personally say has changed my life because it has allowed me a healthy and automatic management of my finances

But Jean how does this method work?

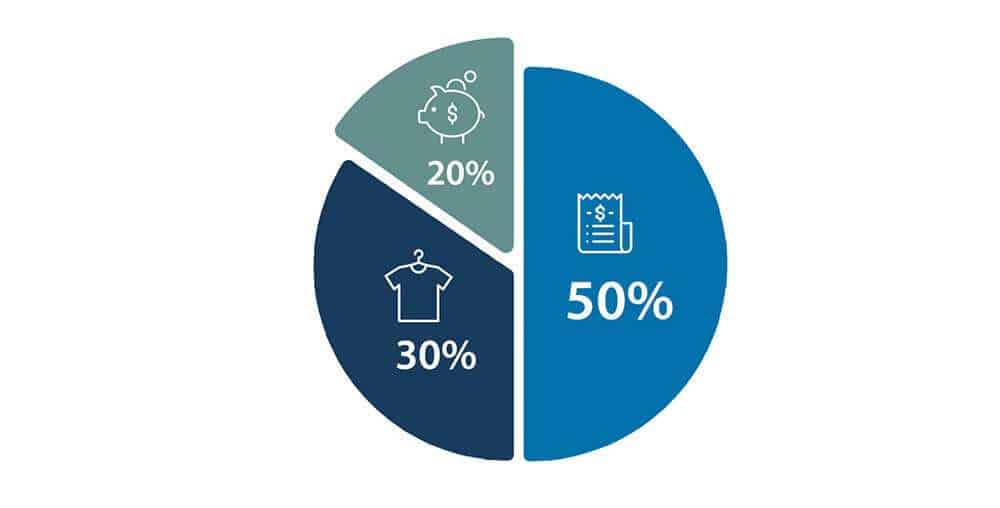

This method allows you to divide your money into 3 broad categories according to the type of expense:

once the categories and the amount of money to be allocated have been defined, the management of your finances will be sound and practically automatic

A system that you will see will allow you to get the security and peace of mind that only people with excellent financial education have in terms of money

Stay with me and you will learn the very useful and very practical 50/30/20 method

WHAT IS THE 50 30 20 RULE?

but since I believe that in life we can reach all goals if we put our heart, perseverance and work into it.

I decided to find a solution to my problem

To remedy this situation, I started reading a slew of books on personal finance and slowly becoming passionate about it.

Until one day I came across Elizabeth Warren ‘s book – ” All Your Worth ” and her 50/30/20 method

A book really full of interesting ideas that I recommend you read

NOW I WILL EXPLAIN THE RULE

this rule allows, thanks to the help of percentages, to allocate a precise budget according to the type of expenditure

- the 50 represents the percentage of essential and vital expenses that you must not exceed

- the 30 represents the percentage of expenses for your pleasures and entertainment

- the 20 represent the percentage to be set aside in savings and investments

BUT HOW DOES IT WORK IN PRACTICE?

Let’s take for example an average Italian with a salary of 1200 euros / month and use the rule.

We’ll have..

I detail the calculations so that everyone can reproduce the calculations:

Wage 1200 €

50% of 1200 => (1200: 100 ) = 12 * 50 = 600 €

600 euros which will be allocated to rent and expenses that you cannot afford not to pay

30% of 1200 => (1200: 100) = 12 * 30 = 360 €

360 euros which will be destined for outings, trips or pleasures in general

20% of 1200 => (1200: 100) = 12 * 20 = € 240

240 euros which will be allocated to savings and investments

HOW TO APPLY THE 50 30 20 RULE

Now let’s see in a bit more detail what this all means

50% of the budget you have to use for vital and compulsory expenses,

compulsory expenses are expenses that you cannot afford not to pay

example:

- Rent / Mortgage

- Diet

- Electricity

- Insurance

- Taxes

- Transportation

- Internet and telephony

You have to be careful not to exceed 50% to stay within the budget , so you always need to know where you are and for this it is very useful to have a book of accounts

a book of accounts, which can easily be a small notebook where you keep the list of your expenses

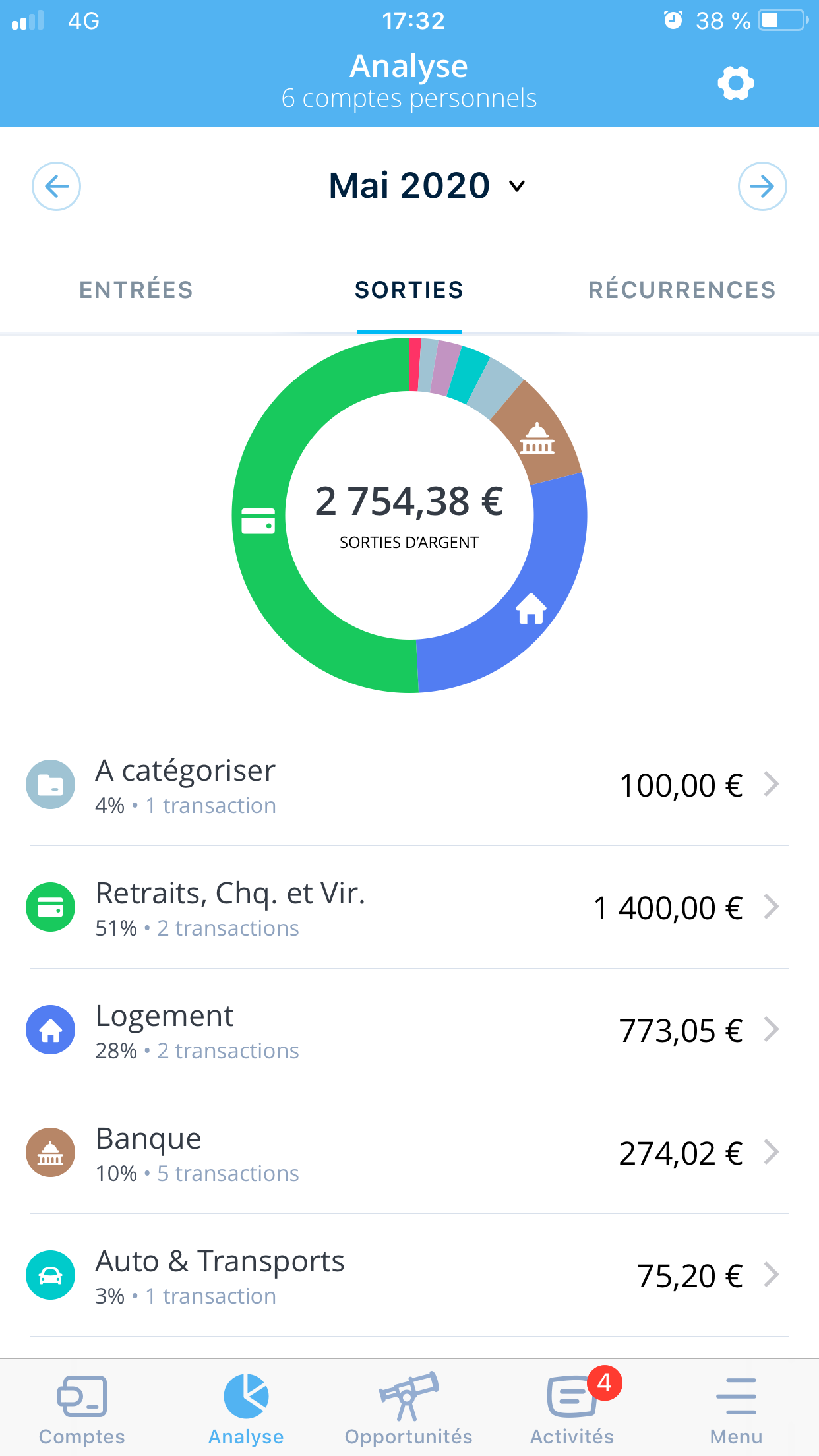

There are budget management applications that help do this type of calculation and allow you to have a global view of your situation

I recommend Bankin which is the application that I also use ..

Thanks to this application, you will have a global view of your expenses and you will be able to categorize them quickly and automatically,

so you can see if you are below or exceed 50% for your mandatory expenses and take the necessary measures

Bankin is much more convenient and practicalthan banking applications which are often impractical, complex and made with little attention to the customer

this is a screenshot of the application where you can see my expenses for the month of may,

you can see how the application automatically divides

the expenses into the different categories, in this case I translate the French for you 🙂

- “A categoriser” are the expenses that he was unable to categorize in this case it was a bank transfer of 100 euros that I had made

- “Retrais, Chq. et Vir. ” are wire transfers, payments by check and when I go I withdraw money from the distributor

- “Logement” is the rent

- “Banque” are bank charges, mortgage or loan installments, or various bank charges

- “Auto & Transports” are the expenses related to cars such as gasoline, or for those who use public transport the cost of the season ticket

plus for people who have more than one bank account,

Bankin allows you to link all your bank accounts to the application in order to have a global view of your finances in a single application

Absolutely to download !!!

You can also use the bank statement that your bank releases you every month on their website where you can find the list of all your expenses for the month, but alas it will not be divided into categories

30% are for expenses related to pleasures

Here is a list of what we can consider as pleasure expenses:

- Vacation

- Restaurants

- Visits (parks, zoos, museums)

- Shopping

- Various subscriptions (gym, netflix)

Also in this case you have to do the same procedure as before and you have to calculate 30% of your salary

in the end..

20% are the expenses for savings and investment

here is the list a little more detailed:

- Deposit account

- Accounts Receivable Deadline

- Certificates of deposit

- Saving account

These savings are what will form your financial security,

and management could be further optimized by dividing savings into two categories:

fixed and mobile savings,

Fixed savings is where you lock your money for a long time while mobile savings is an easy-to-access account

depending on the months your expenses can change and to consider this I suggest you make an average of your expenses over at least three months to get realistic percentages

HOW TO COMPLY WITH THE RULES

Once you know how much you can spend depending on the type of expense, you need to commit to sticking to the rules over the long term

Here are some techniques:

1) pay for the pleasures in cash

The expenses are fixed, which means that they do not change from one month to the next, the only expenses that can unbalance your budget are those for the pleasures

A good way to not spend more than expected is to use contacts,

if you pay in cash you have your money in your hand, the money is physical and your mind more easily realizes the magnitude of the expense compared to a paper purchase

In fact, when we pay with a credit card, we often don’t even realize how much we spend

Especially now that there are technologies such as contactless (without contact) that allow us to pay without even having to type our pin

and we tend to forget more easily the amount of the shopping just completed

2) buy what you need at the Drive

the Drive is the site of the shopping center,

by buying at the Drive you will have the opportunity to create a virtual shopping cart that will allow you to always buy the same things every month and have them sent home

this has several advantages:

- It allows you to always buy the same things and therefore to have a constant amount of your spending easier to manage in your account book

- It avoids you shopping that I call ” emotional shopping “, which are what we do when we are angry, happy, hungry…. simply when we are taken by some particularly strong emotion

- It saves you time

3) set up an automatic transfer to your savings

We often have the wrong habit of wanting to save at the end of the month and we find ourselves at the end of the month with less money than expected and therefore we end up not putting aside …

ABSOLUTELY NOTHING !!!!

it happens to everyone don’t worry!

A wise way to meet the 20% savings goal is to place an automatic transfer in the days following the arrival of your salary to your savings account.

WHAT ARE THE ADVANTAGES OF THE 50 30 20 RULE

The advantages of this rule as you will have well understood is the fact that it is easy to understand and just as easy to put into practice,

the calculations are extremely easy and once the method is in place you don’t need to worry about it anymore

moreover it is a system that also allows you to please yourself because 30% of your earnings are destined for pleasure

and 30% are not at all few at all 🙂

THE LIMIT OF THIS SYSTEM

The 50/30/20 method allows you to start with the first steps in managing your money

the limitations of the method is that a system that is not very strong in the long term,

in fact, to maximize the income generated by investments, it is necessary to calculate your budget much more precisely

also because we all have different economic, family and work situations and we also have different goals so everyone should refine their management according to their dreams and goals

In conclusion

This method has allowed me to improve and simplify my financial management and above all to feel more serene, happy and freer.

The worries I felt when I was having trouble making ends meet turned into serenity and lightness

and allowed me to start investing in the long term for my future,

I currently have several investments in stocks and other financial instruments that I continue to grow thanks to the 50/30/20 method

and that bring me interests that increase every year and that ensure my future.

And you? did you know this method?

And above all, what do you think?

I hope I have given you some useful information

and remember to take #Each day one step towards your dreams

Until next time!!

Your friend

Jean